Blog

Background

Lebanon signed on 17 June 2002 an Association Agreement with the EU creating a Free Trade Area. Its economic and trade provisions were provisionally applied as from 2003, based on an Interim Agreement which entered into force on 1 March 2003. The Association Agreement fully entered into force on 1 April 2006. The Agreement liberalized two-way trade in industrial goods with an asymmetrical transition period of 12 years in favor of Lebanon. In regard to agro-food trade, the Agreement granted tariff free access to the EU market to most Lebanese agricultural and processed agricultural products (i.e. 89% of products enter tariff and quota free), with only 27 agricultural products facing a specific tariff treatment, mostly Tariff Rate Quotas (TRQs).[1]

Among the list of agricultural products that are subject to the TRQs, virgin/extra-virgin olive oil is one of the top items exported to the EU-27. For instance, Lebanon is allowed to export annually 1000 tons of virgin/extra-virgin olive oil to the EU-27 at a zero tariff[2], while it’s worth mentioning that the third country duty is fixed at 124.5€/100 kg (≈1.15€/1L). However, having an EU-LB trade agreement in place does not automatically imply that the virgin/extra-virgin olive oil exported from Lebanon to the EU is benefitting from zero (preferential) tariffs. There is a necessity to prove that the products are eligible for trade preferences provided by the agreement. Preferences are only used if the clearing agent asks explicitly for it in the customs declaration form, to be then submitted to the customs authorities of the country of destination.

According to the statistical office of the EU, Lebanon has exported, during the period 2019-2022, about 205 tons of virgin/extra-virgin olive oil to the EU-27. Only 51% (104 tons) benefitted fully from duty savings in the sense that all the tariff preferences were utilized. The tariff preferences were not utilized at all for imports of the remaining 101 tons. The foregone/potential duty savings amount to €126k. In contrast and during the same period, the EU’s imports of Lebanese olive oil (excluding virgin and extra virgin) amounted to 185 tons. Tariff preferences were utilized for 174.2 tons, resulting in a preference savings rate of 94 %. The total amount of actual duty savings on the exported 174.2 tons was about €235K [third country duty is fixed at 134.6€/100 kg for this type of olive oil (different from virgin and extra virgin)]. Given these numbers, the question arises as to why some shipments of virgin and extra virgin olive oil obtained in Lebanon and exported to the EU27 are not benefitting the available tariff preferences under the EU-LB agreement?

[1] The reader is referred to pages 25-26 of the Association Agreement for additional details concerning TRQs.

[2] The concession applies to exports of virgin/extra-virgin olive oil obtained in Lebanon (EUR1 certificate of origin) and transported directly from Lebanon to one of the 27-EU member states.

Implementation issues

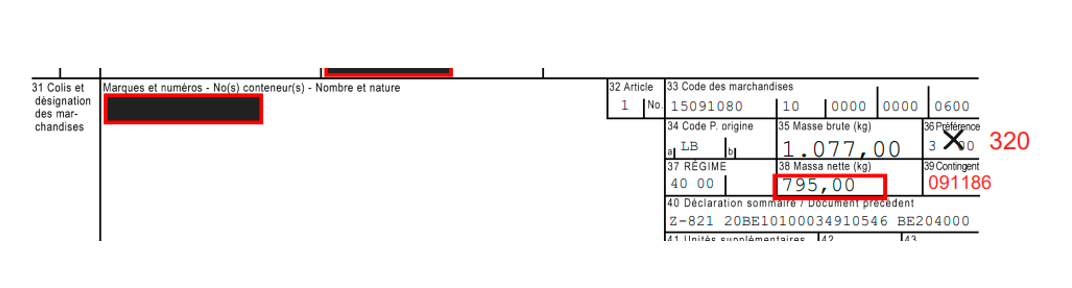

A thorough investigation was conducted to discover a common error when filling out the custom declaration form. The box 36 (“Preference”) in the customs declaration form should contain a code related to the tariff regimes to be applied on the goods. One should distinguish between the code 300 (preferential duty rate without limits) and the code 320 (preferential tariff quotas: the preferential duty rates are applicable only within the limits of quotas). As can be seen from the declaration attached, the clearing agent claimed the tariff preferences based on the code 300, while the code 320 should have been used instead to avoid duty costs; given that virgin olive oil is subject to TRQs. Therefore, the importer had to pay €989 on the 795kg, that is, a cost that could have been avoided. In addition, when using the code 320 in the box 36, the declarant has to enter, in box 39 (contingent/quota) the order number of the tariff quota for which he is applying. In the case of virgin/extra-virgin olive oil obtained in Lebanon, the order number is set to 091186.

This issue usually occurs when the virgin or extra virgin olive oil is being transported in a mixed container loaded with different goods, for most of which the code 300 (preferential duty rate without limits) applies. We should recall what has been mentioned in the first paragraph, the agreement granted tariff-free access to 89% of Lebanese agricultural and processed agricultural products, with only 27 agricultural products facing TRQs.

Recommendations

- In general, it is important to check the custom tariff applied, using the Access2Markets tool, before exporting any product to the EU27.

- When it comes to olive oil, a distinction must be made between

- Virgin and extra virgin olive oil.

- This category is subject to TRQs. Hence, the clearing agent should be informed to apply the code 320 in the box 36 in the customs declaration form and the order number of the tariff quota 091186 in the box 39.

- For exporters who had to pay the custom duties, it is possible to submit a regularization request, via the clearing agent, to claim for refund of the paid duties within three years of the clearance date.

- Olive oil (excluding virgin and extra virgin). This category is not subject to TRQs, hence it can be exported to the EU27 without limits. The code 300 applies in the box 36 in the customs declaration form.

Dr. Saadallah Zaiter is the economic attaché in the Lebanese Embassy in Brussels since 2019.