Industry Capabilities

Discover our industry capabilities

With a proven record of innovation throughout the years, rooted in resilience thanks to the nation’s, adaptive and transformative capacities, Lebanon can be your preferred choice for business. Discover below our comparative advantages in key industries.

The agriculture sector in Lebanon have been witnessing considerable growth in recent years thanks to increased investment in new crops cultivation and adoption of innovative and automated technologies.

Based on Food and Agriculture Organization (FAO) data, more than 64% of Lebanon’s land is suitable for agriculture production. The country has one of the highest rain precipitations in the Arab world which allows the cultivation of more than 60 type of crops. In terms of output, potatoes grasped the largest share of agricultural production in 2020 (628,000 tons) followed by tomatoes (271,000 tons), apples (245,000 tons), oranges (160,000 tons), wheat (140,000 tons), olives (136,000 tons), cucumbers and gherkins (120,000 tons), lemons and Limes (106,000 tons), bananas (83,000 tons) and onions (69,000 tons) (Source: FAO Statistics).

Although the agriculture sector accounted for around 3% of national output in 2020, the sector’s value add has been growing at a CAGR of 5% between 2004 and 2019 indicating strong growth potential (Source: Central Administration of Statistics, Lebanon). It is equally a major employer in the economy employing around 12% of the labor force especially from the rural areas.

In recent years, the sector has been undergoing steady transformation that is helping Lebanon to move towards higher added-value crops and produce. The Agrytech Innovation acceleration program by Berytech is leading on this transformation and has supported the development of the first Agrytech cluster in the Middle East called QOOT Cluster. The cluster gathers producers, exporters, input suppliers all working in the field of agriculture and agri-food industries.

The agriculture sector is dominated by small farms averaging 1.4 hectares. About 70% of farm operators cultivate less than 1 hectare and only 4% of farms operate on more than 6 hectares. Commercial agriculture accounts for 25% of total agriculture holdings and is considered efficient, and export-oriented while the rest is non-commercial farming or considered subsistence agriculture.

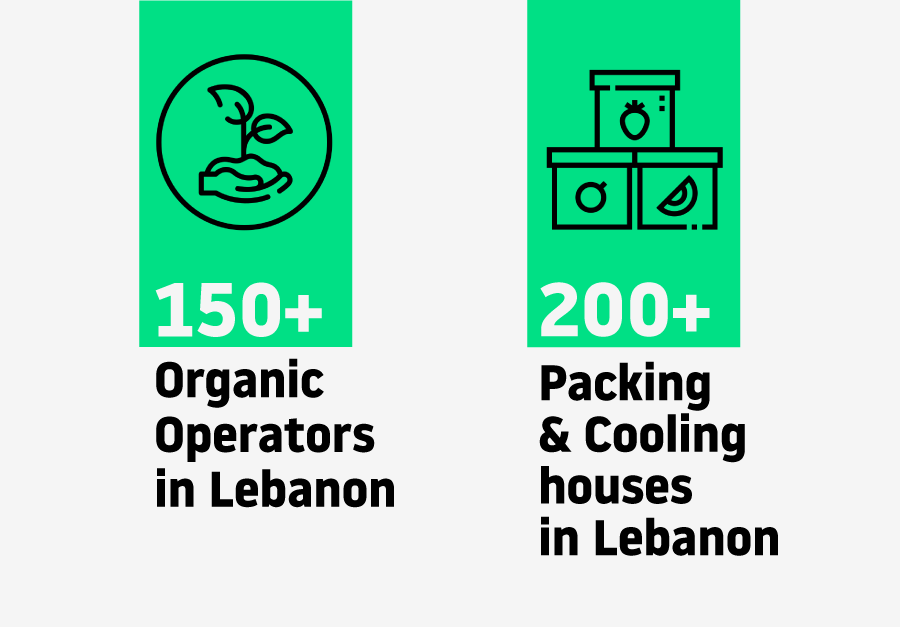

There are more than 200 agriculture packing and cooling houses in Lebanon with 44% of them located in the Bekaa region alone (Source: IDAL Database). Those packaging houses are in majority exporters that buy produce from farmers directly and sell them in regional and international markets.

Organic and pesticides-free agriculture production is picking up due to increased local and regional demand. In 2019, Over 150 organic companies are operating in Lebanon with an organic certificate, up from 110 in 2016.

There is a growing trend for hydroponic production that offers higher yields with less pesticides and fertilizers than the conventional way of cultivation. Aquaponics is equally growing in popularity with various firms operating their own fish farms including salmon farms in Lebanon.

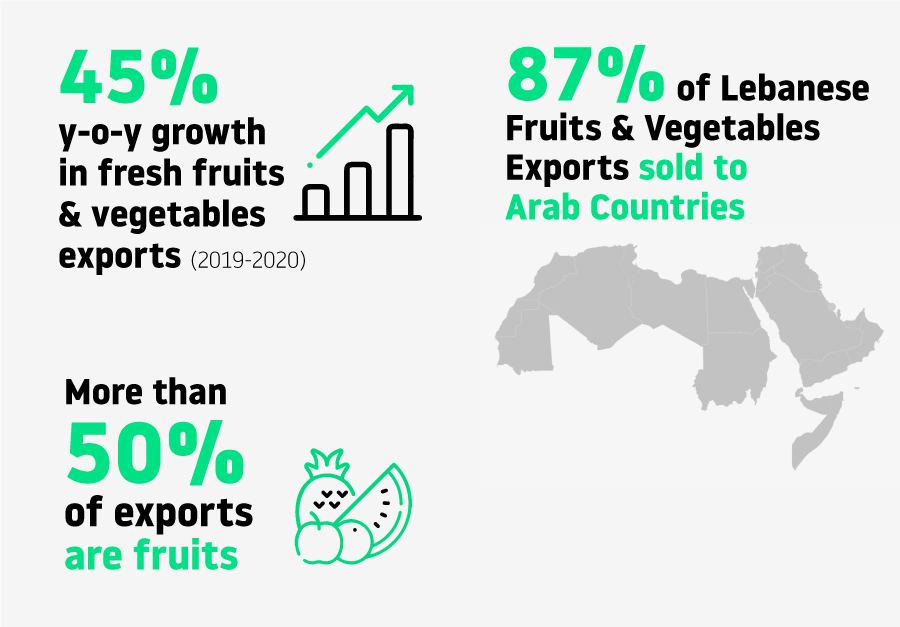

The agriculture sector has witnessed an impressive growth in exports in 2020, with exports of fresh fruits and vegetables reaching 1.6 million USD, a 45% growth from previous year level and registering the highest peak in 10 years.

More than 50% of exports were fruits, while vegetables accounted for 19% of total agricultural exports. More specifically, bananas, grapes, pine nuts, citrus fruits and potatoes were the main exported products from Lebanon in 2020.

Agriculture exports are mostly destined to the neighboring GCC countries as well as some other Arab countries like Iraq, Jordan, Egypt. In 2021, 87% of the Lebanese exports of fruits and vegetables, valued at 59.7 million USD, were destined to the Arabian countries. On the other hand, exports to Europe only grasped a 4.4% share with 2.9 million USD for the same year.

Natural Assets: Lebanon benefits from vast agriculture arable land allowing the cultivation of variety of crops.

Innovative Agrytech Ecosystem: Lebanon has a burgeoning innovative Agrytech ecosystem that is supporting the development of cutting-edge solutions to increase competitiveness of Lebanese agriculture sector.

Skilled Labor Force: Lebanon has a skilled labor force that can support the development of a strong agriculture export industry.

Lebanon has a unique geography, climate and human capital that create unrivalled conditions for producing diversified, traditional but yet innovative food products that are increasingly being appreciated around the world.

The agri-food sector is a major contributor to Lebanon’s industrial sector growth and is expected to continue to play a major role in the economy, driven by private sector investment that aims to boost its competitiveness.

In 2019, the agri-food sector was the largest contributor to the industrial sector output, accounting for 41% of the manufacturing output and generating 3.1% of the country’s GDP (Source: Central Administration of Statistics, Lebanon). The sector is also a major employer, accounting for 25% of the industrial sector workforce.

The sector has an estimated size of 1.7 billion USD and its output has grown at a CAGR of 9.4% over the 2010 and 2019 period (Source: Central Administration of Statistics, Lebanon)

Discover below one of our top exportable products and why we are good at producing them.

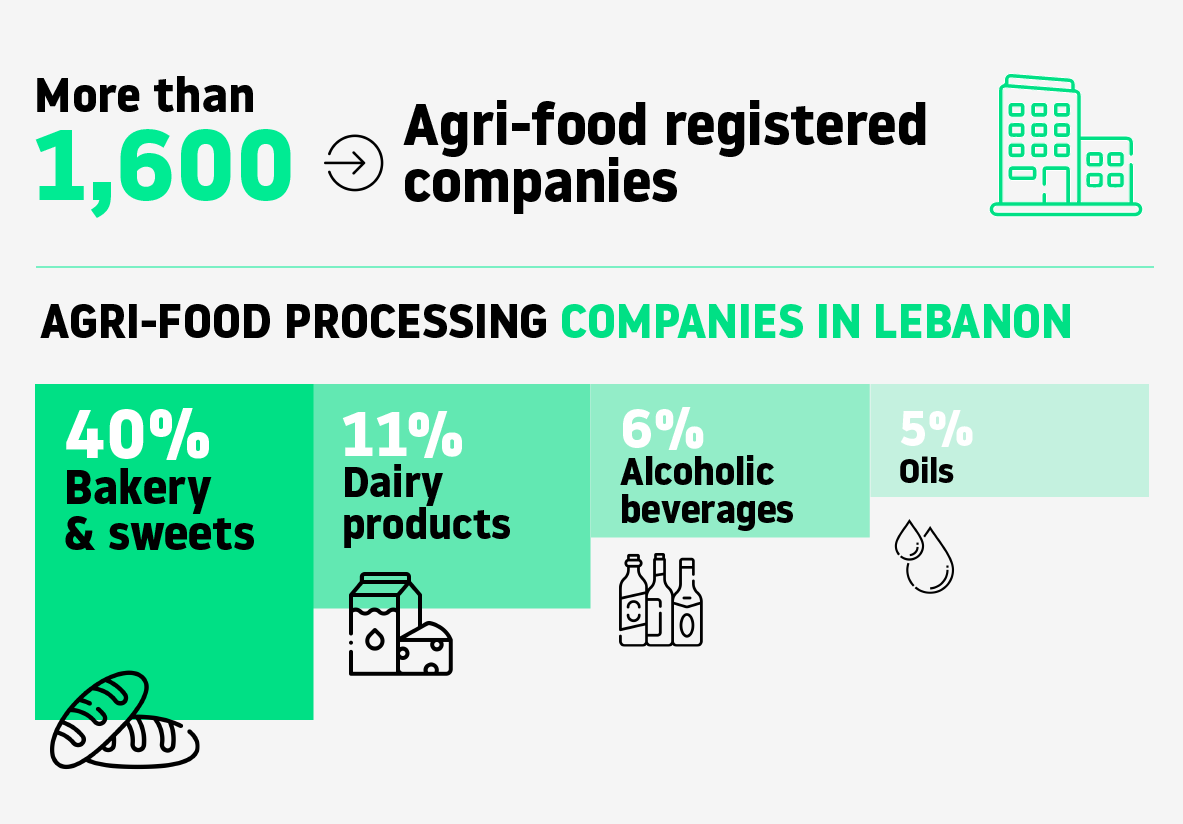

There are around 1,600 agri-food formally registered companies constituting the largest share of total industrial firms in Lebanon (Source: Ministry of Industry 2020 database). The majority of them follow international best practices in terms of food hygiene and apply a rigorous food safety management system to produce safe, delicious and authentic Lebanese food and beverages products.

Around 40% of agri-food processing companies in Lebanon are in the bakery and sweets sub-sector followed by dairy products at 11%, alcoholic beverages at 6% and oils at 5%. They are also mostly concentrated in Mount Lebanon region with more than 48% of all agri-food firms located in this region alone.

Companies in the sector are mostly family-owned small businesses with more than 78% of them employing between 5 to 20 employees. These companies pride themselves with their inherited family recipes and have since worked on adapting them to emerging new trends.

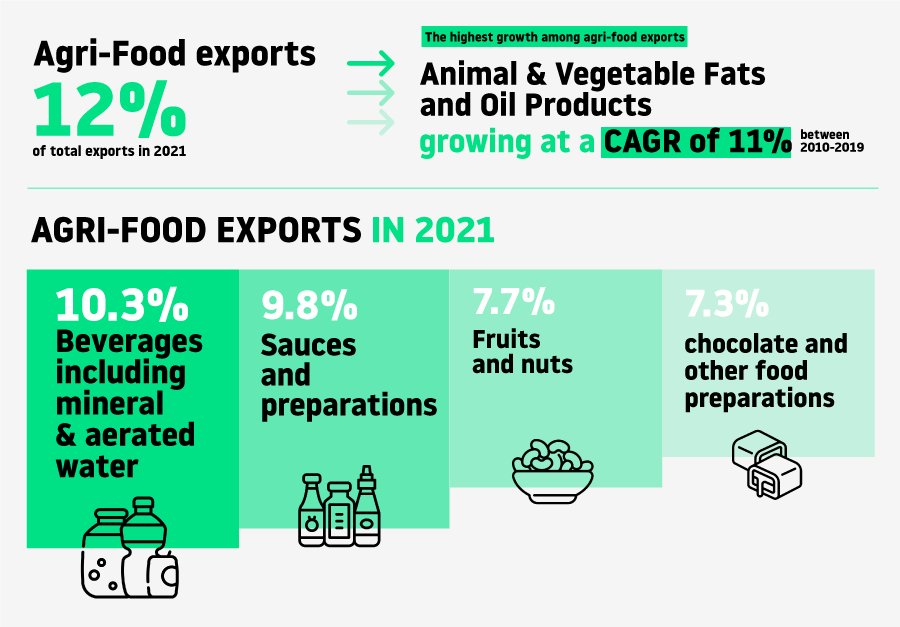

The Lebanese Agri-food industry has become highly internationalized over the years, exporting to more than 200 countries in 2021. Agri-Food exports accounted for 14% of industrial exports and 12% of total exports in 2021 (Source: Lebanese Customs).

Beverages including mineral and aerated water had the highest share of agri-food exports in 2021 at 10.3% followed by sauces and preparations at 9.8%, fruits and nuts at 7.7% and chocolate and other food preparations at 7.3%. Residues and waste from the food industries registered the highest growth among agri-food export categories, growing at a CAGR of 8% between 2012-2021 while total agri-food exports increased at an annual growth rate of 2% between 2020 and 2021.

Agri-food exports are mostly destined to neighboring countries in the Arabian Gulf. In 2020, Saudi Arabia was the top destination of Lebanese agri-food exports representing 13.1% of total exports followed by the US at 9.1%.

.

Skilled Human Capital: Lebanon has excellent education and specialized/vocational training facilities supporting the food and beverage industry with highly skilled labor force.

Diversity in Production: Lebanon is endowed with a moderate climate, rich soil, and abundant water resources that allows the development of a diverse range of crops that are used as input material in the processing industry. We have more than 60+ types of crops and 10+ livestock products available in the country.

Strong Packaging Industry: Lebanon has a strong packaging industry with more than 250 companies working in the sector. Owing to major investments from international organizations, the industry has become pioneer in the development of innovative and eco-friendly packaging solutions that supports the food and beverages industry.

Stringent Regulatory Framework: Registered and formal food and beverages companies in Lebanon undergo strict inspection procedures from relevant authorities. Our industry standards follow the international food safety standards such as the CODEX Alimentarius standards. Our network of internationally accredited laboratories allows the testing and inspection of food products to ensure they are compliant with all safety measures.

Strong Culinary Reputation: Lebanese restaurants are witnessing increasing demand in international markets due to the growing awareness on the Mediterranean Levantine culinary heritage, its sophistication and associated health benefits. This demonstrates increased demand for Lebanese food ingredients that can be supplied by Lebanese food producers.

The industrial sector in Lebanon has a major role in boosting the country’s resources towards economic recovery and sustainable growth. In 2020, the industrial sector (including construction) accounted for 6.8% of total GDP, with the manufacturing sector contributing 3% to total GDP. In terms of employment, 24% of the total labor force is engaged in the industrial sector.

Based on the Central Administration of Statistics, the main industrial sectors in the country with highest contribution to industrial GDP in 2019 were Agri-food production (41%) followed by metal products, machinery and equipment at 22% of total manufacturing GDP. However, other burgeoning industries are growing and expanding, such as the pharmaceutical sector, cosmetics, and creative industries to address local demand looking to substitute imported products as well as regional demand.

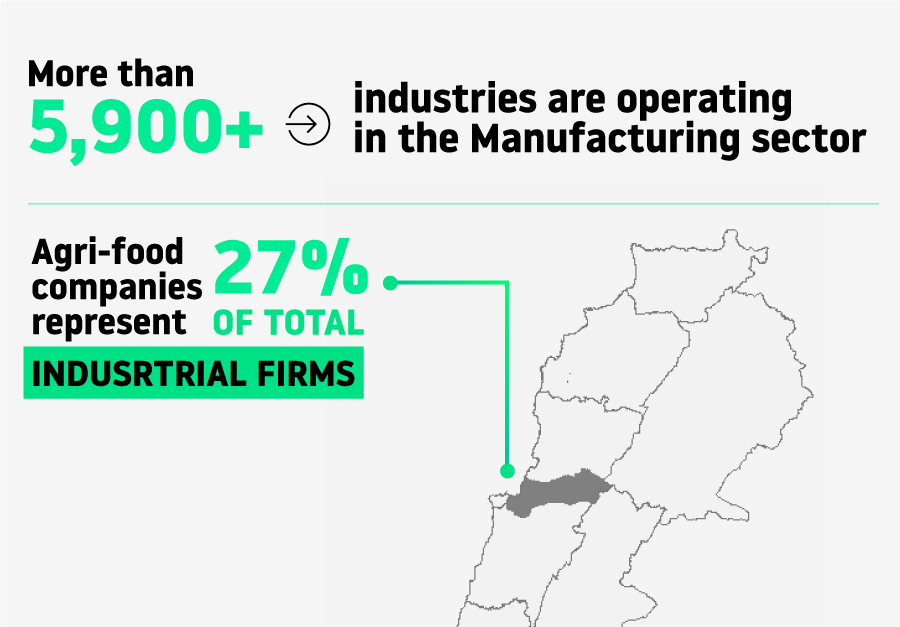

Based on 2020 data, around 5,900 industrial establishments are formally registered in Lebanon with largest number of firms in the Agri-food industry, representing 27% of the total.

Construction material companies comes in second place (636 companies) followed by Chemical products manufacturing companies (473 companies). Furniture and wood manufacturing also has a prominent place in Lebanon with around 7% of industrial establishments, ranking 4th out of total industrial establishments.

Industrial firms are mainly concentrated in Mount Lebanon Governorate with more than 27% of firms located in the Metn region, followed by Zahle in the Bekaa Governorate.

.

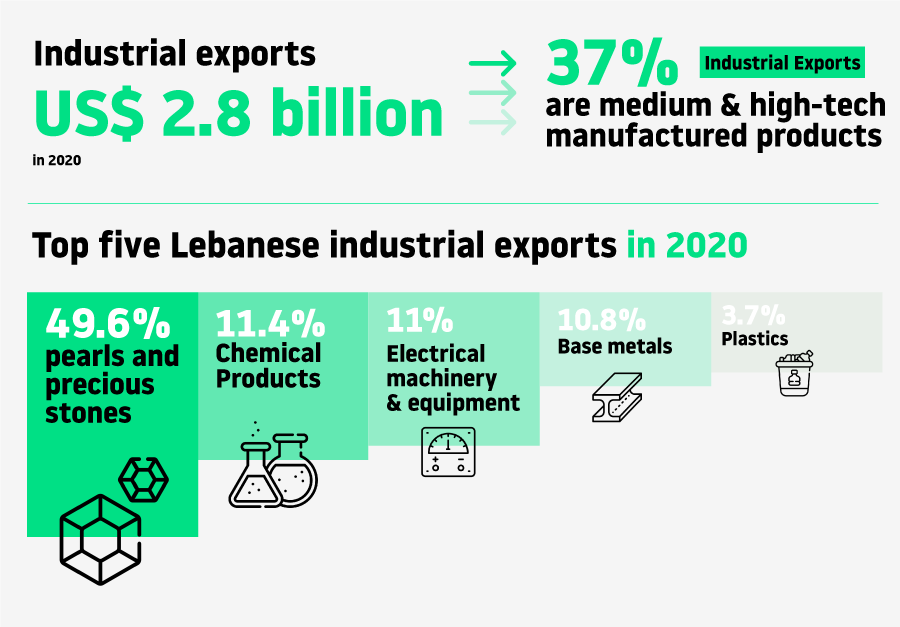

Industrial exports stood at US$ 2.8 billion in 2020, accounting for 80% of total Lebanese exports.

Top five Lebanese industrial exports in 2020 are pearls and precious stones (49.6%), chemical products (11.4%), electrical machinery and equipment (11%), base metals (10.8%) and plastics (3.7%).

Key export destinations in 2020 included Switzerland (with 30% of total industrial exports), United Arab Emirates (with 12% of total industrial exports), Saudi Arabia (with 6% of total industrial exports), Syria (with 5% of total industrial exports), and Iraq (4%).(Source: Lebanese Customs)

The share of medium and high-tech manufactured exports of total manufactured exports reached 37% in 2019 growing from 27% in 2000 indicating promising technological capabilities in the sector and increased sophistication.

Skilled Labor Force: Lebanon has a skilled yet highly competitive labor force that can support the development of a strong manufacturing industry. Lebanon ranks especially high in the Science, Technology, Engineering, Math (STEM) skills which are very much needed for the manufacturing industry. In 2019, Lebanon ranked 10th in the world for the Ease of finding skilled employees, 23rd for the digital skills among active population and 24th for the skillset of graduates (The Global Competitiveness Report, 2019).

Strong Creative Industry sector: Lebanon has a strong creative industry sector that is particularly successful in the fashion, jewelry, furniture and accessories design. Many brand names for Lebanese designers from these industries became global trademarks with international recognition.

Lebanon’s ICT and technology ecosystem has evolved over the years and matured thanks to major investments by the Government and the private sector.

In 2019, the ICT sector contributed to only 2% of Lebanon’s GDP however it has been growing at an average rate of 4% since 2004 (Source: Central Administration of Statistics).

Based on IDAL database, there are around 10,150 high-skilled individuals employed in ICT services and manufacturing sector, the majority falling in in the Software industry. The Lebanon Economic Vision developed by Mckinsey in 2018 puts the number of employees in the ICT and business services industry at around 80,000 people representing 4% of total employment in the country.

Based on IDAL ICT database, there are around 550 companies involved in ICT Services and hardware manufacturing. Majority of companies are considered small and medium-sized businesses.

Start-ups in the tech industry have grown tremendously especially after the introduction of Circular 331 by the Central Bank of Lebanon that facilitated investments in the technology start-up ecosystem.

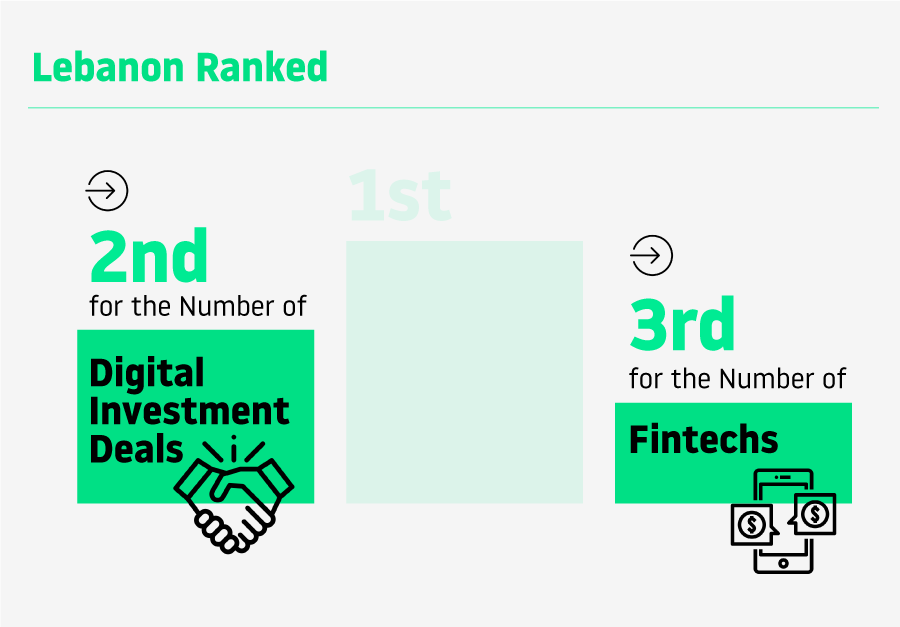

Arabnet, a major media and research consultancy company focused on tech startups, estimates that more than 100 investments or start-ups developments happened between 2013 and 2016. In 2018, Arabnet ranked Lebanon 2nd in the MENA region in terms of digital investments with 40 closed deals outpaced by only UAE with 45 deals. In fact, Lebanon ranked first in terms of number of deals per capita and per GDP. Moreover, Lebanon and Jordan ranked first in the region for the highest proportion of female founders.

The fintech industry in Lebanon has particularly grown so fast. Based on Arabnet research, Lebanon hosts more than 16 fintech start-ups ranking third in the region in the number of fintech start-ups.

Edutech and healthtech start-ups have also flourished in recent years given the high availability of skilled doctors and medical professionals in the country as well as the strong education system especially the private one.

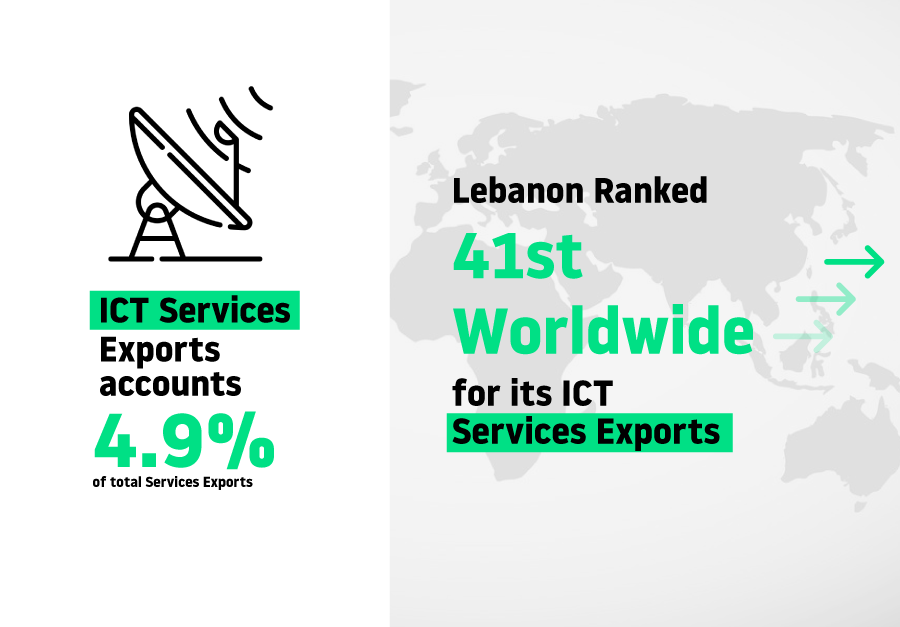

ICT services exports have more than doubled over the last decade, reaching 4.9% of total services exports in 2020, up from 1.3% in 2002 (World Bank Data). Based on the Global Innovation Index 2020, Lebanon ranked 41st out of 131 countries for the ICT services exports as % total trade.

Based on IDAL survey, more than 50% of ICT companies in Lebanon indicated that the GCC remains their largest export market.

Skilled Labor Force: Lebanon has a skilled yet highly competitive labor force that can support the development of a strong ICT and technology industry. Lebanon ranked 10th among 141 economies in the ease of finding skilled employees and 23rd for the digital skills among active population in the Global Competitiveness report of 2019.

Strong Support Network: Lebanon has a strong network of incubators and accelerators that offer world-class coaching and mentoring programs to start-ups and entrepreneurs. This is also supported by various co-working spaces found across the country offering the needed infrastructure to entrepreneurs to thrive and grow.

Lebanon has a renowned cultural and media industry that have flourished and produced over the years major performances and productions that have reached global stage. Despite all the challenges that the country has faced, the sector has all the enablers to succeed: mainly the access to a pool of creative talent that is unmatched in the region and natural endowments that makes Lebanon an inspiring place for cultural production.

Moreover, the freedom of expression and the liberal lifestyle distinguishes it from other countries and allows the development of a strong media industry.

The media industry in Lebanon encompasses several sub-sectors including television broadcasting, advertising services, audiovisual production, publishing, music production as well as digital media. In 2020, Lebanon ranked 49th worldwide for its Entertainment & Media market (per thousand population 15–69 years old) and 55th for its National Feature Films produced (per million population 15–69 years old) (Global Innovation Index, 2020).

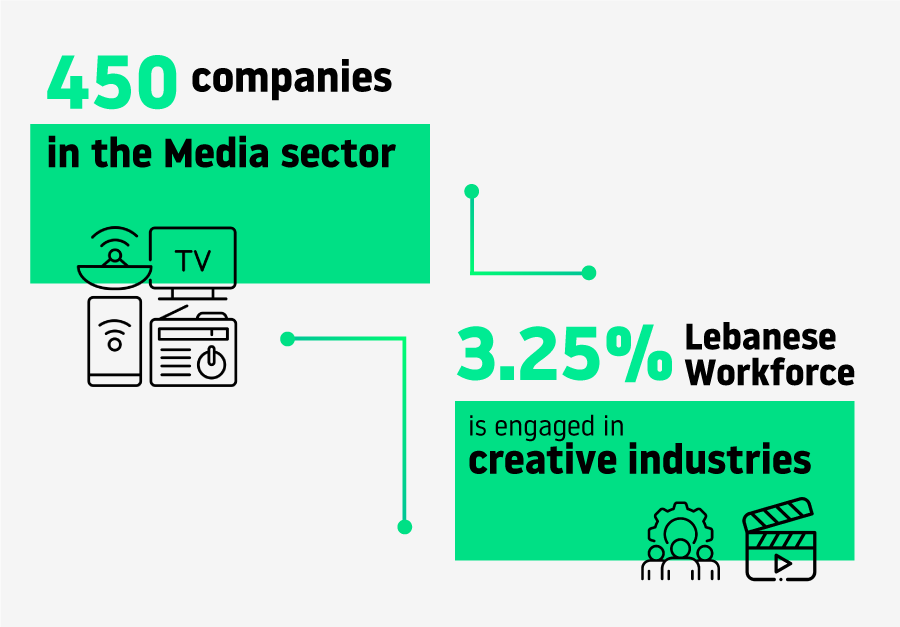

The creative industry sector employs around 3.25% of the Lebanese labor force. Based on IDAL’s latest database, the media sector comprises around 450 companies. The industry is becoming more organized with the establishment of associations and clusters that promote the talents in this industry and advocate for reforms to protect and allow the growth of this vital industry for the local economy.

The Beirut Creative Cluster was established in 2012 with the aim to support the creative and digital industry through promotion, networking and collaboration. Fondation Cinema Liban is another important association that aims to support the local film industry and promote Lebanon as destination for filmmaking.

Lebanon was ranked 7th worldwide for the culture and creative exports as % of total trade based on the Global Innovation Index of 2020 indicating promising creative industry in Lebanon that is able to compete worldwide. The score of culture and creative exports jumped from 0.6 in 2018 to 1.9 in 2020 showing strong growth potential despite the challenges of the pandemic and its devastating effect on the cultural and creative industry.

Talented and creative workforce: Lebanon is distinguished in the region by the availability of highly skilled talent. Based on the Global Talent Competitiveness report of 2019, Lebanon ranked 10th out of 125 economies on the ease of finding skilled employees, 23rd for the digital skills and 24th for the skillset of graduates.

Liberal media sector and adequate legal framework: Lebanon enjoys a highly liberal media sector with freedom of expression highly valued and protected in the Lebanese laws and legislation. Lebanon has always ranked top in the Press freedom index especially compared to other countries in the region.